In the face of global financial transformation, the MSc in Sustainable and Green Finance (SGF) Capstone Project serves as a catalyst for innovation and impact. Over the course of six months (January – July), students collaborate with leading industry players from sectors such as banking, investment, consulting, and sustainability advocacy. Tasked with tackling complex, high-impact business challenges, they work in teams to define critical problem statements, engineer strategic solutions, and drive measurable change. Under the mentorship of both industry leaders and NUS faculty, they navigate the intricate intersection of sustainable finance.

This is more than just an academic exercise— it’s a launchpad for leadership in the sustainable finance arena. By the project’s completion, students emerge not only with deep technical expertise but also with the agility, critical thinking, and strategic foresight demanded by today’s rapidly evolving financial landscape.

This is where vision meets execution. Where ideas become impact. Students collaborate with leading organisations across sectors such as banking, investment, consulting, and sustainability advocacy, working under the guidance of our esteemed faculty and the MSc Programmes Experiential Team.

The companies we worked with for AY23/24 SGF Capstone Projects:

- Bank of Singapore

- CGS International Securities Pte. Ltd (CGSI)

- GIC

- KPMG Singapore

- Neuberger Berman

- Prudential Assurance Company Singapore

- World Wide Fund for Nature (Singapore)

- SGX

We are grateful to our esteemed industry partners for their invaluable insights and mentorship, their expertise has been instrumental in advancing sustainable finance education and preparing our students for leadership roles in the evolving financial landscape.

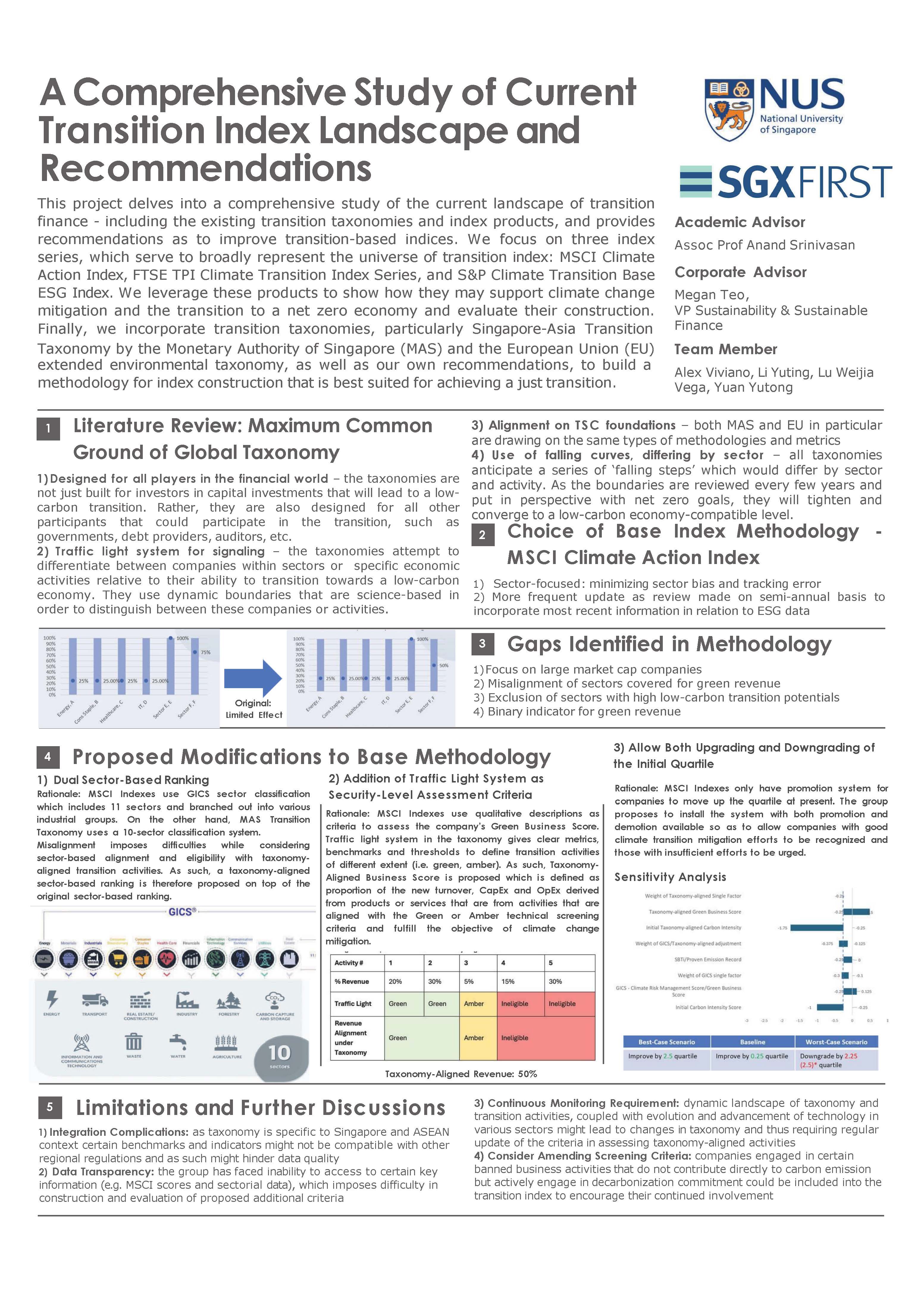

In 2023 and 2024, we hosted two gallery walks to showcase a selection of Capstone projects through posters and team presentations, highlighting critical topics in sustainable finance and investment, including:

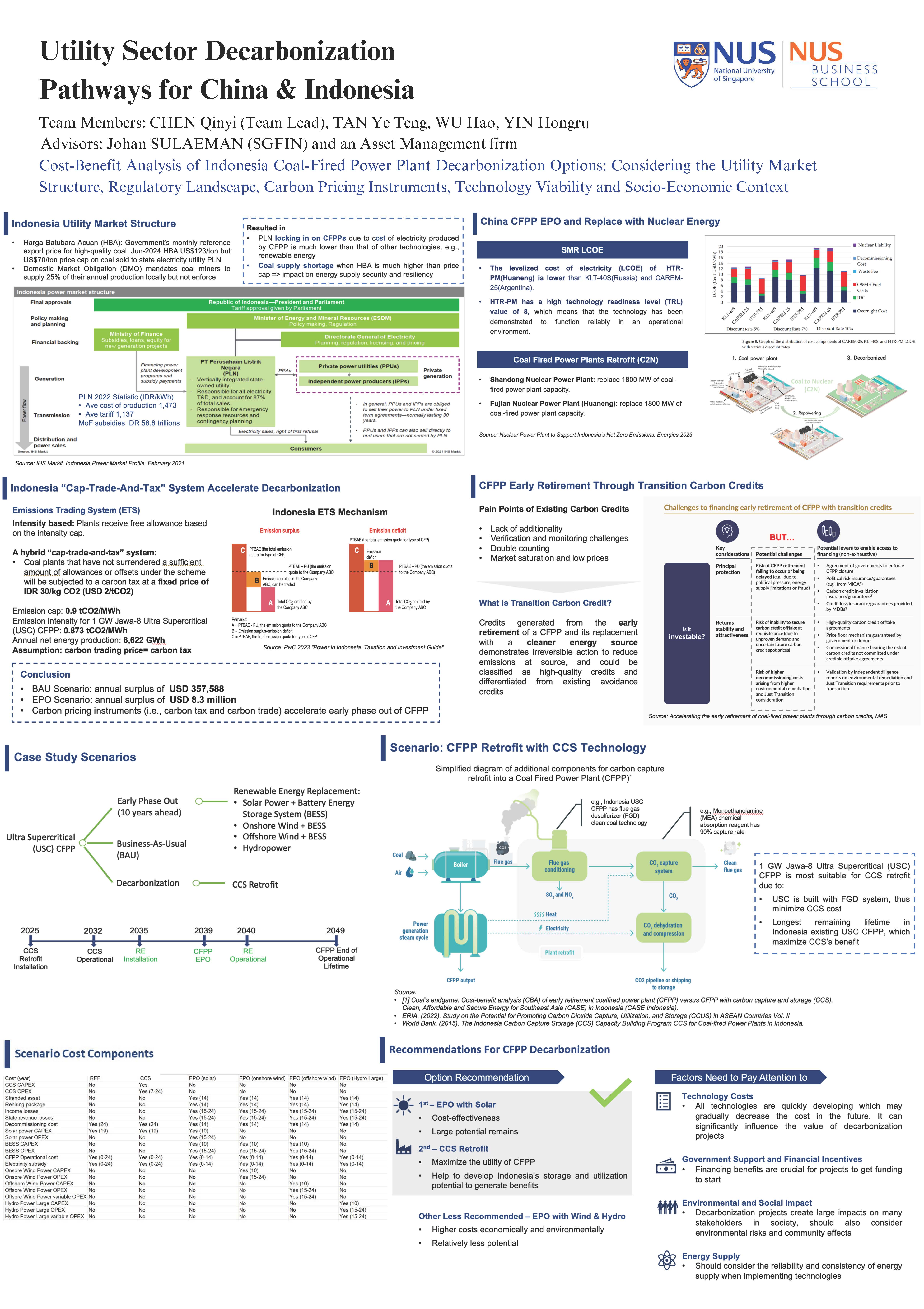

- Energy transitions, with a focus on the early decommissioning of coal-fired power plants

- Nature and biodiversity risks and their influence on business operations

- Decarbonization strategies for infrastructure and utility sectors

- Climate stress testing and financial resilience assessments

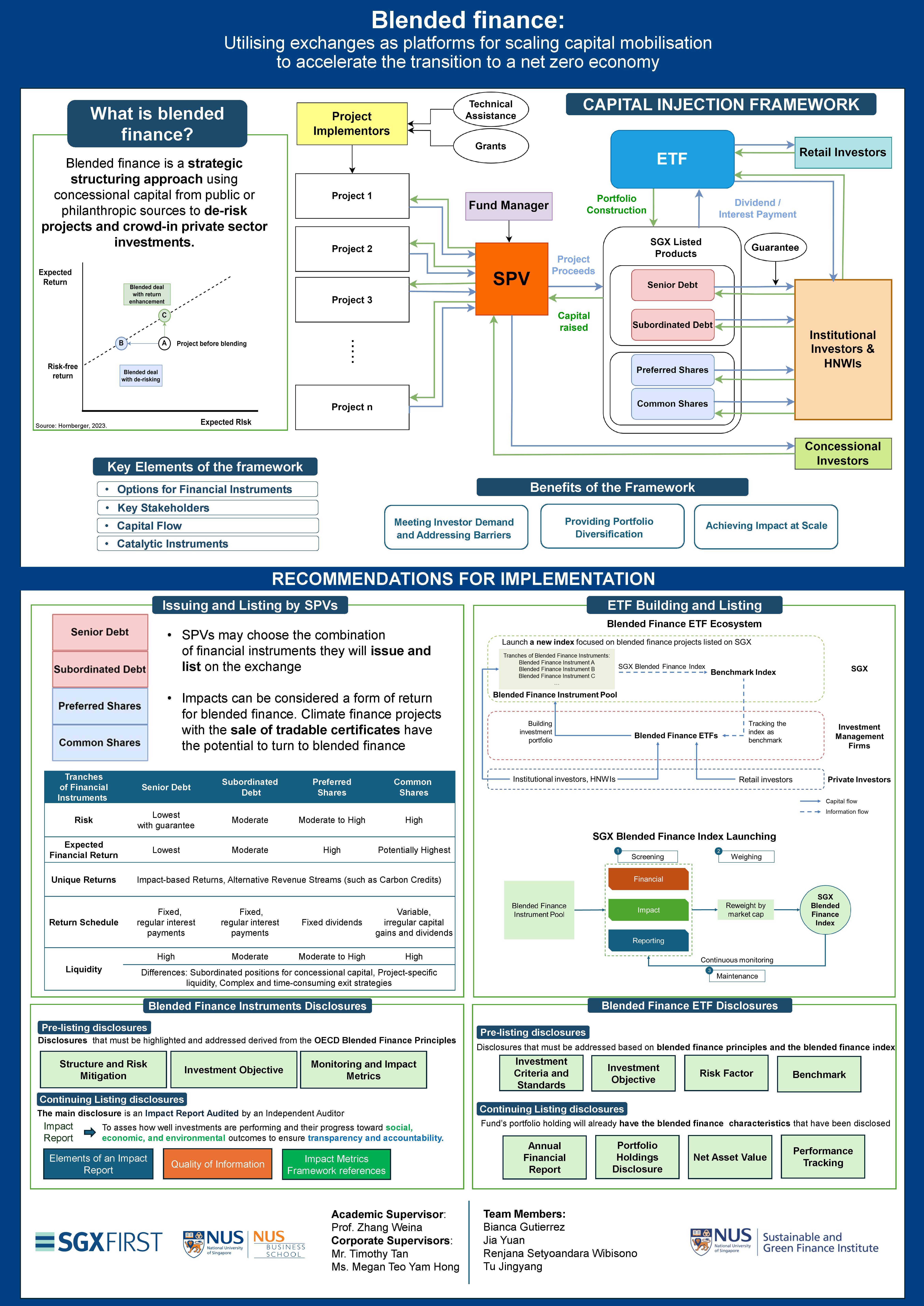

- Blended finance mobilization to drive sustainable investments

- ESG investing trends, including investor awareness and preferences

Past Capstone Projects

Visit the Gallery Walk AY22/23 event page to view more capstone project posters from AY22/23.